Certified payroll reports (prime contractor and subcontractors)

Last updated: 2026-02-04

WisDOT is phasing out the current Civil Rights Compliance System (CRCS). The entry of certified payroll reports (CPRs) in AASHTOWare Project Civil Rights and Labor Payroll (AWP CRL Payroll) will begin with contracts awarded in January 2025. Entry of CPRs for contracts awarded in December 2024 and early will continue in the CRCS. Contract IDs start with the year they were awarded (e.g. 20250114001).

Tip: Click on the thumbnail image below to expand and view the content.

Prime contractor and subcontractors are required to enter or import their employee certified payroll reports (CPRs) into AWP CRL Payroll to verify compliance with federal and state laws and regulations. Following one of the processes below, all prime contractor and subcontractor CPRs will be entered or imported following a standardized processes. Once data entry is complete, the CPR will be signed by the contractor who entered it, signed by the prime contractor, and submitted to WisDOT for review and approval.

A CPR is the prime contractor or subcontractor's reporting of wages paid to employees for work on a specific WisDOT project for a specific period of time. For each employee, the hours worked each day for a given labor classification on a contract must be reported. This is not the prime or subcontractor's payroll system for payment and payroll tax deduction purposes, but rather a record based on the output from their payroll system.

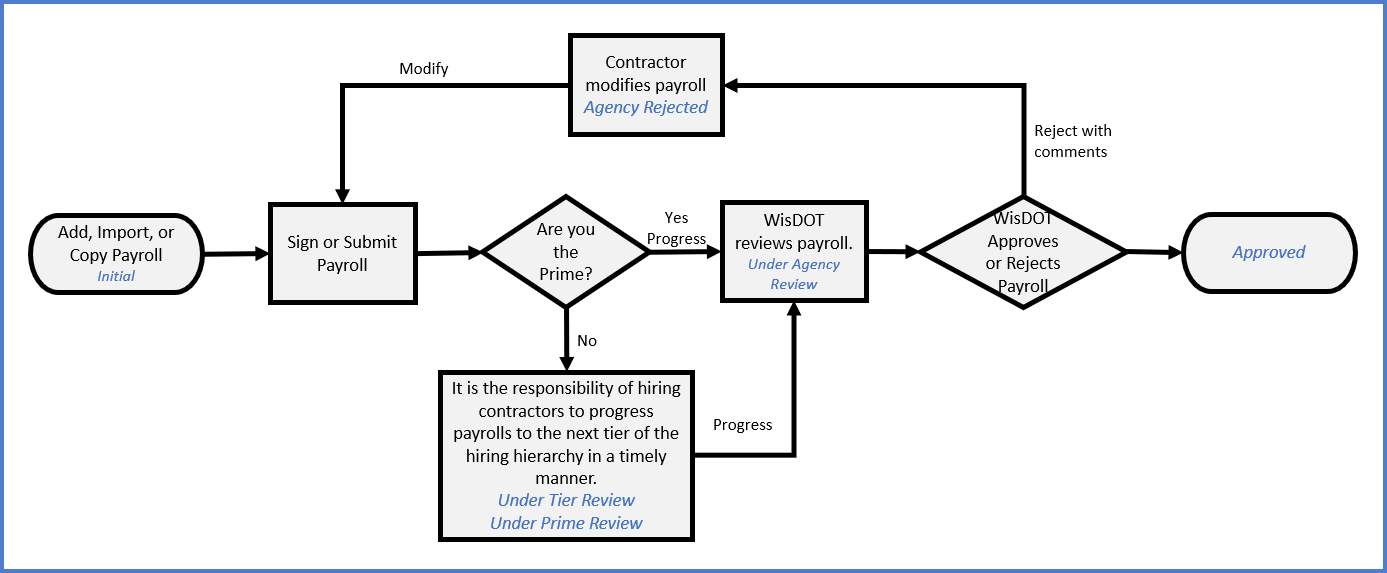

The Payroll Flowchart below shows how AWP CRL Payrolls handles each element of the payroll submission and review process.

To enter CPRs for WisDOT, vendors are required to have the following accounts and complete the following steps:

-

Obtain a Wisconsin Web Access Management (WAMS) account if you don't already have one. Go to WAMS account management for details.

-

Ensure your company is registered in the WisDOT Vendor Registration System (VRS) and the Payroll Contact is entered. Go to Vendor Registration System (VRS) for details.

-

Request an AASHTOWare Project™ (AWP) account to log into AASHTOWare Project Civil Rights and Labor Payrolls (CRL Payrolls) to enter CPRs. Go to AASHTOWare Project accounts | Request an AWP account for details. If you already have an AASHTOWare Project™ (AWP) account, go to AASHTOWare Project™ accounts | Modify an existing AWP account to request the addition of the Payroll role.

-

Once a confirmation is received that your company is assigned to a WisDOT contract, log into AWP CRL Payrolls using the WAMS ID and associated password to begin entry of CPRs.

Getting started: